💼 US full-time independent workers doubled. Student debt forgiveness bills stalled. Banking AI adoption accelerates.

Chart of the Day #530 looks at independent full-time workers in the US, student debt forgiveness in the US, and AI infrastructure spending.

Hello 👋

National Group forms board to develop clean tech workforce. Arkansas to upskill advanced manufacturing workforce. West Virginia receives $1.2M in health grants. FPT to expand AI powered solutions across South East Asia.

Georgia approves a national framework outlining reforms to modernize the general education system. India launched its first AI-enabled university, Rishihood University, with Google Cloud. India upskills 50,000 doctors in digital healthcare.

In today's newsletter:

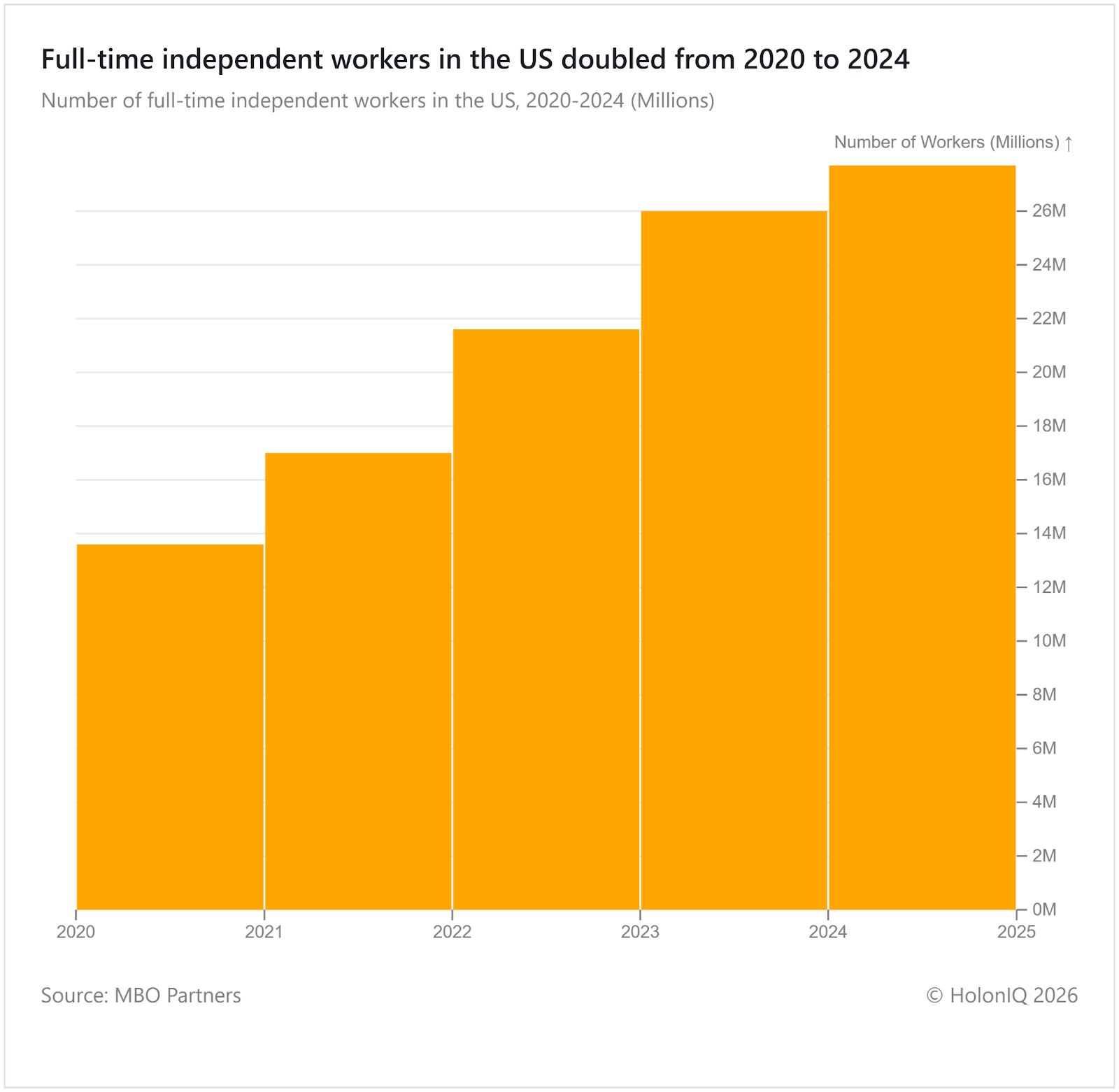

💼 Workforce. Independent full-time workers doubled alongside expanding gig economy

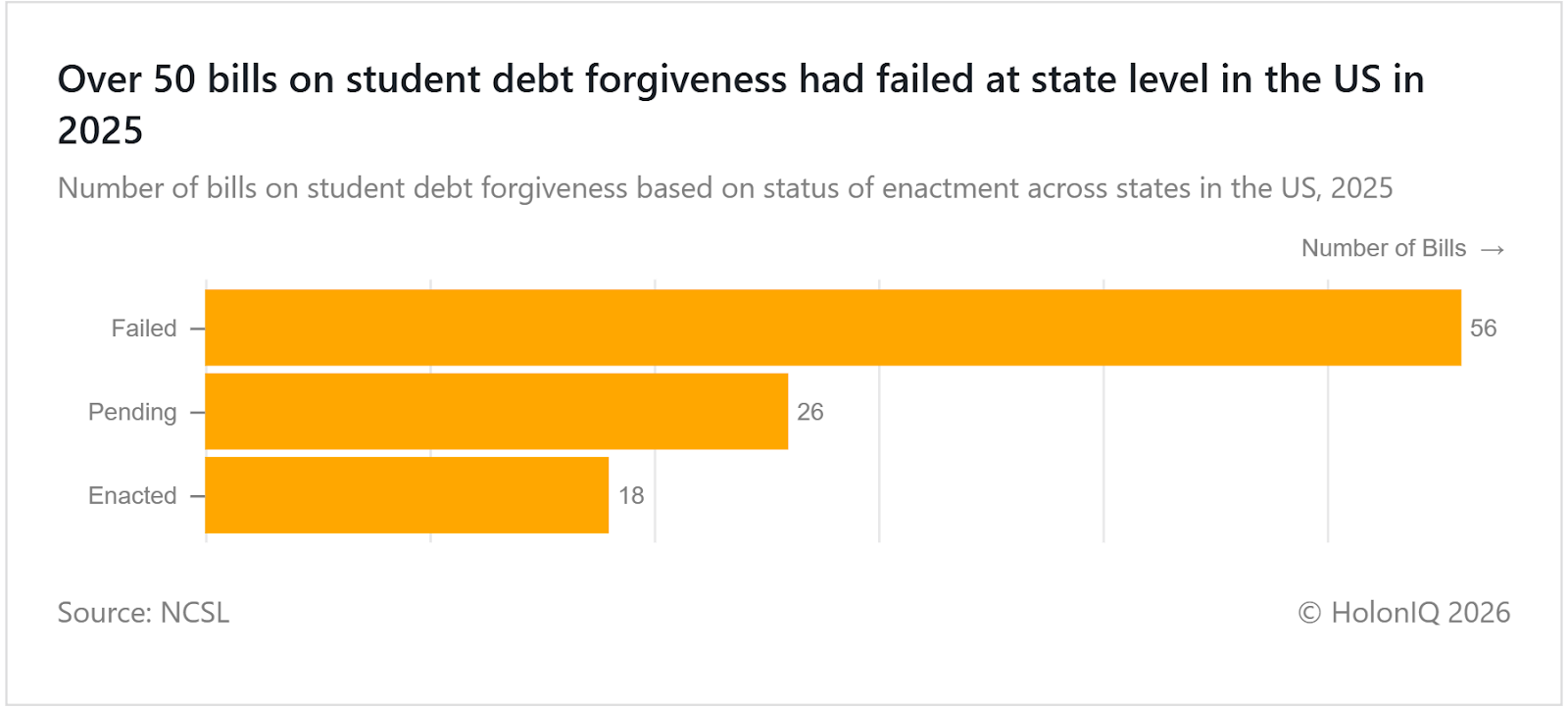

💵 Funding. Over 50 state student debt forgiveness bills did not advance

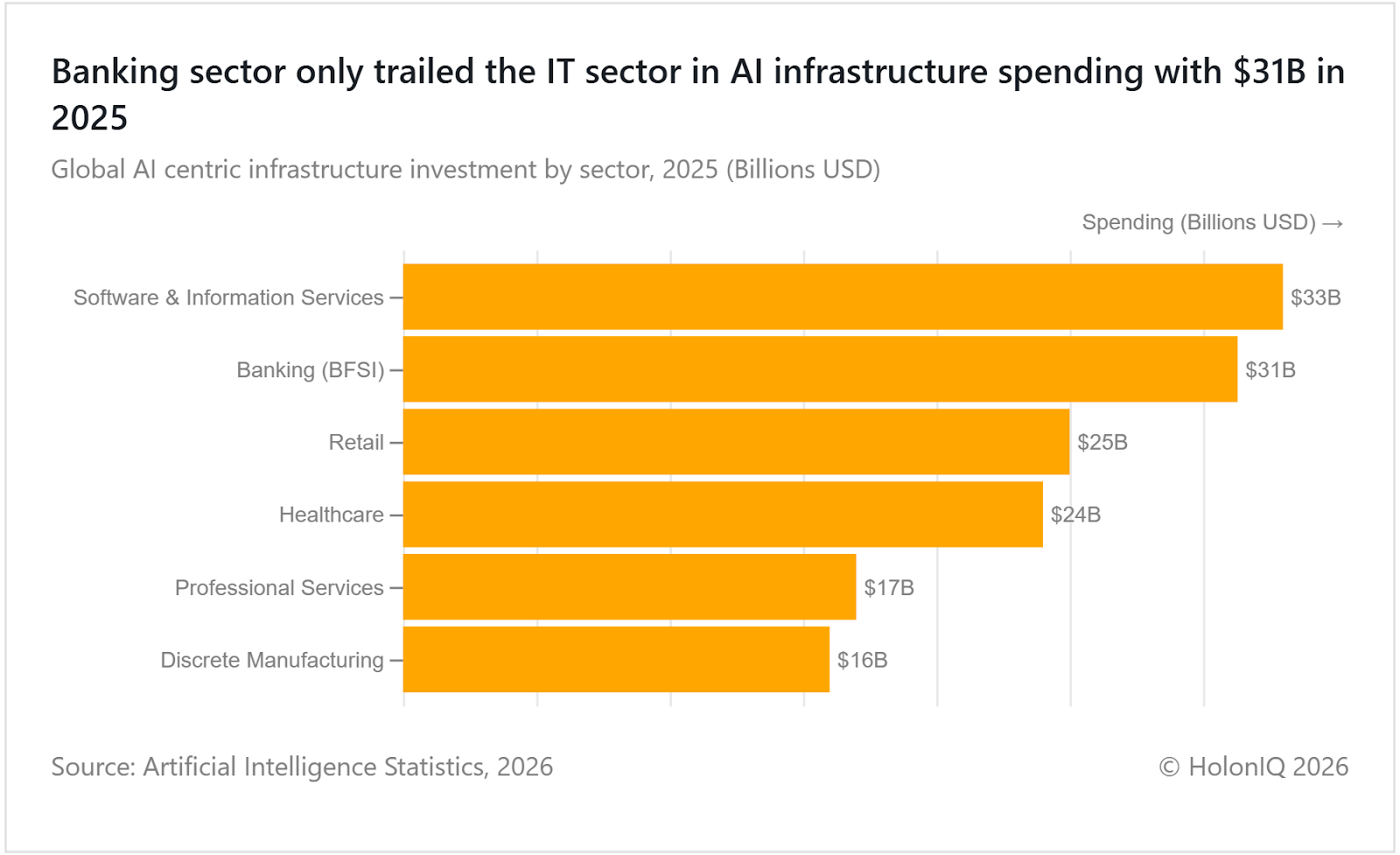

🤖 Artificial Intelligence. AI adoption accelerates in the banking sector

Thanks for reading!

Not a subscriber yet?

💼 Independent full-time workers doubled alongside expanding gig economy

From 2020 to 2024, full-time independent workers in the US increased from nearly 14M to almost 28M, reflecting a shift toward flexible, self-directed work. Growth is strongest in freelance tech, creative services, consulting, food delivery, and ridesharing platforms, as well as online content creator roles, which continue to expand with increasing market demand. This shift has also given rise to gig-based platforms such as Uber, Lyft, Fiver and Upwork. While independence offers autonomy, flexibility and diversified income, it has also sparked income instability, uneven benefits access, tax complexities, and gig-economy burnout, prompting calls for portable benefits and stronger labour protections as the segment scales.

💵 Over 50 state student debt forgiveness bills did not advance

In 2025, 18 state-level student debt bills were enacted, while 56 did not pass and 26 remain under consideration, reflecting fiscal constraints and political resistance at the state level. Efforts to provide relief have increasingly shifted to the federal level, where previous administrations expanded programmes like PSLF, SAVE, and income-driven repayment, cancelling over $180B in debt. The implementation of these initiatives continues to face challenges, including processing backlogs and adjustments to funding systems.

🤖 AI adoption accelerates in the banking sector

Banking spent $31B on AI infrastructure in 2025, trailing only IT's $38B, with banks such as JPMorgan investing $2B annually. AI applications focus on lending, KYC/AML checks, fraud detection, and AI copilots for customers. This increased AI adoption targets to achieve productivity gains and repurposing certain business functions. However, risks include algorithmic bias and cybersecurity concerns, as regulators push for stress testing to avoid system failures.

Like getting this newsletter? Request a demo for unlimited access to over one million charts

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at qs.com.